Written in Obamacare,

transitional reinsurance is a fee disguised as a levy on insurance companies that is passed through to all consumers. It is a temporary program that cost each covered person a set annual dollar amount. In 2014 every insured person was charged $63. This reduced to $44 in 2015 and is set for $27 in 2016.

All group plans - self funded and fully insured - as well as individual plans pay this fee. But,

the only ones who benefit from the fee are insurers who have high claimants in Obamacare compliant individual plans.The original design assumed consumers would pay $12 Billion in 2014, $8 Billion in 2015 and projects for $6 Billion in 2016. $10 Billion would pay off insurance companies who incurred loses and $2 Billion would go to the U.S. Treasury to reduce debt. In 2015 there would be $6 Billion to pay off insurers and another $2 Billion for the U.S. Treasury. For this year there would be $4 Billion to fund insurance company losses and $1 Billion to the Treasury.

The way that insurers would get money back was based on a formula for large claims. The government determined a base dollar amount and a cap they would pay for claims an insurance company incurred. There was also a coinsurance percentage associated with it. The original floor for claims was set at $60,000 ($75,000 in 2015 and $90,000 in 2016)

with a cap of $250,000. The coinsurance was set for 80% in 2014 and 50% in 2015.

Here's an example of how the program should have worked. Assume an insurer has a large claim of $210,000. They pay the first $60,000. The remaining $150,000 would be split with the insurer paying $30,000 (20%) and the government paying the insurer $120,000 of money you paid into the reinsurance program. Once all of the claims were paid out the remainder would go as a payment to the U.S. Treasury for debt reduction.

The outcome is much different. Like most government programs, this one over-promised and is under-delivering.

First, the actual collection numbers were

$9.7 Billion in 2014 and

$6.5 Billion in 2015 - more than 20% lower than projected. While this is an important development, it is what the Obama administration did next that really cheats you as a taxpayer.

Insurers only requested payments of $7.9 Billion for 2014. At a coinsurance rate of 80% the amount that HHS should have distributed was $6.3 Billion. This would have left $3.4 Billion and resulted in the U.S. Treasury receiving their $2 Billion contribution and allowed the program to carry over $1.4 Billion.

What happened?

The Obama administration chose to "change" the law in final regulations. They lowered the floor (attachment point) to $45,000, down from $60,000. Then, instead of a coinsurance rate of 80% they upped the ante to 100%. Doing so gave insurers an additional $1.6 Billion in payments leaving $1.7 Billion which one would assume would be a payment to the Treasury. Except they didn't. They took the full $1.7 Billion and rolled it into the 2015 program leaving the U.S. Treasury with nothing.

Which brings us to now.

CMS recently released the 2015 payments and data. The first interesting point was the increase in payment requests. The requests totaled $14.3 Billion. Yet HHS estimates on reinsurance payments projected it would go down as the years go forward. They believed that the first year would be the worst and then the market would correct itself. Obviously that's not happening and it appears that it is getting worse. The collections total $6.5 Billion. Taking the current $6.5 billion and adding the $1.7 Billion that rolled over gives HHS a cool $8.1 Billion to play with for this year.

At a coinsurance rate 50% on $14.3 Billion in requests the CMS should be paying out $7.1 Billion and give the Treasury $1 Billion. But of course they didn't. Instead they upped the coinsurance rate to 55.1% and paid out $7.8 Billion. The remaining amount of roughly $500 Million is going to the Treasury.

The first two years is proof that there is no method to the Obama administration's madness. They simply do what they want regardless of their responsibility to follow the rules of a law they championed.

The Obama administration lied and stole from you the taxpayer. All for the benefit of the insurance companies - who were supposed to be the ones paying the tab.

(

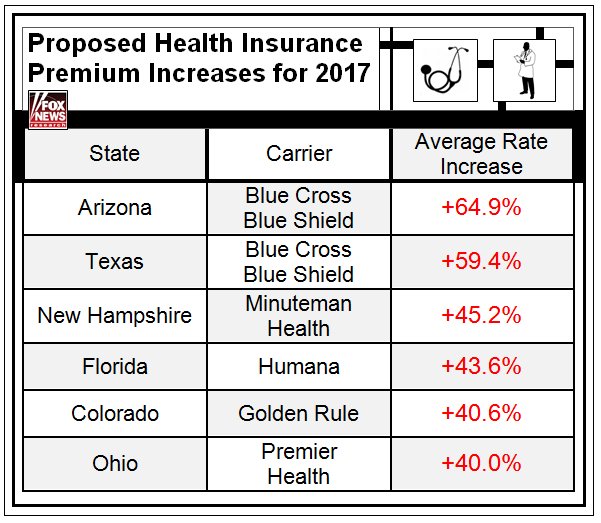

ED NOTE: Image above is a summary of Transitional Reinsurance Program before and after)